Groton Property Tax Records Database

Groton property tax records are handled through municipal offices in Groton, with assessor files, grand list entries, tax billing data, and parcel history maintained under Connecticut law. This page gives a practical search path for Groton property tax records, including local links, statute references, and image-supported source checks. Use these steps when you need to review ownership records, compare assessments, locate payment status, or prepare appeals and exemption filings tied to Groton property tax records.

Groton Property Tax Records Office Sources

Groton property tax records usually begin with local assessor resources and then move to collector billing pages. Connecticut property tax administration is municipal, with assessors and tax collectors at the local level. Real and personal property are assessed at 70% of fair market value statewide. The uniform assessment date is October 1 in Connecticut. Municipal offices maintain grand list records and billing files for local parcels.

Local pages often publish grand list notes, revaluation cycles, and filing deadlines. Contact references for Groton include Use municipal offices in Groton and statewide directories for current contacts.

State-level support for office routing is available at municipal assessor directory and municipal tax collector directory. These tools help keep Groton property tax records searches stable when local menus change.

Groton Property Tax Records Search Links

Groton property tax records links should be used in a sequence: assessment data first, tax billing second, then legal references. This keeps record pulls consistent across different systems.

Primary links for Groton include https://portal.ct.gov/opm/igpp/resources-and-forms/statutes-governing-property-assessment-and-taxation and https://portal.ct.gov/opm/igpp/grants/tax-relief-grants/homeowners--elderlydisabled-circuit-breaker-tax-relief-program. For legal context, keep https://portal.ct.gov/drs and https://portal.ct.gov/opm/igpp/publications/municipal-databases in your file notes.

Records in Groton usually include real estate, personal property, and motor vehicle entries. Due dates, grace periods, and delinquency details should be confirmed on local collector pages before final use.

Groton Property Tax Records Images

The source-linked images below are mapped from the project manifest for Groton property tax records.

Source view for Groton property tax records appears at New London Assessor - New London.

This screenshot supports the Groton property tax records path shown in this section.

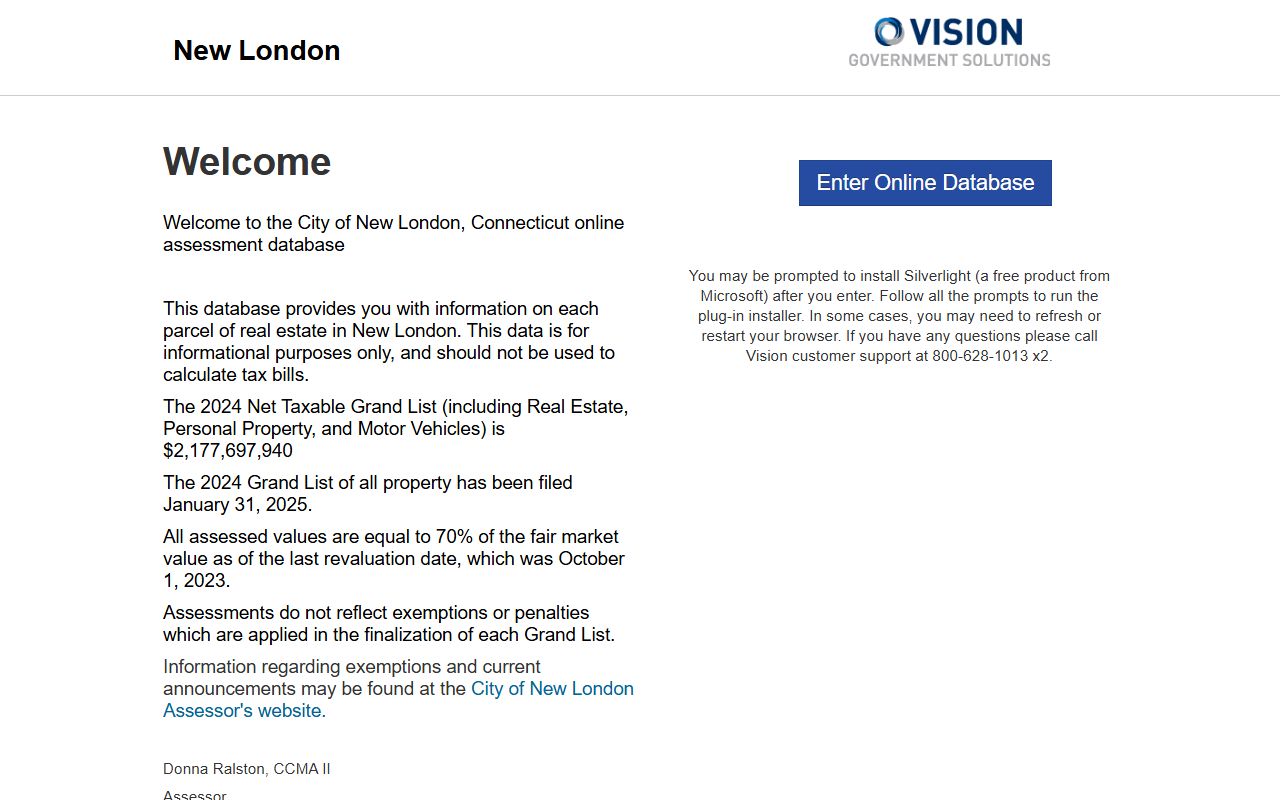

Source view for Groton property tax records appears at New London Assessment DB - New London.

This screenshot supports the Groton property tax records path shown in this section.

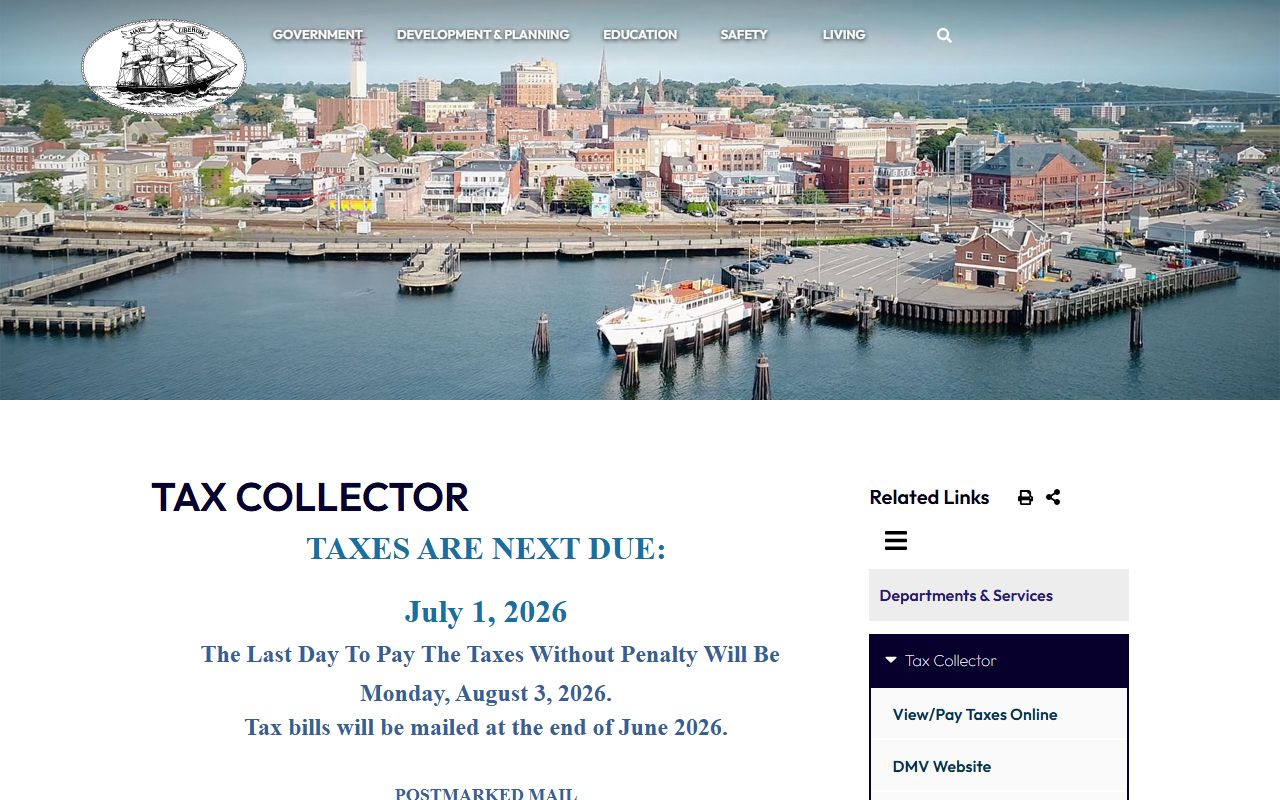

Source view for Groton property tax records appears at New London Tax Collector - New London.

This screenshot supports the Groton property tax records path shown in this section.

Groton Property Tax Records Checklist

Use this checklist when pulling Groton property tax records for routine requests and filing support.

- Open the municipal assessor page and confirm parcel details.

- Check grand list year and revaluation notes.

- Review tax collector billing and due date language.

- Check delinquency rules and DMV-related notices.

- Save reference links for follow-up requests.

This workflow matches how Groton property tax records are maintained in Connecticut and reduces repeat searches.

Groton Property Tax Records Reference Notes

Groton property tax records research usually starts with municipal office pages and then moves to statewide legal context. This approach helps when a local site changes because the local office is still the source of record. It also keeps assessment data, billing data, and exemption timelines in one review path.

Connecticut requires consistent treatment of assessment years, tax due dates, and delinquency status. Keep the same terms across each search session so records from separate portals can be compared. This page is structured to support that workflow for Groton property tax records.

New London County Property Tax Records

Groton sits in New London County. Use the county page for county-level routing links and additional municipality context.