Search Connecticut Property Tax Records

Connecticut property tax records are created and updated at the municipal level, then governed by statewide assessment and collection rules. This guide helps you search Connecticut property tax records across all counties and cities over 25,000 population using assessor databases, tax collector systems, and statute links from official sources. Use this page when you need parcel assessments, grand list context, payment records, exemption guidance, or municipal office routing for Connecticut property tax records in a specific location.

Connecticut Property Tax Records Basics

Connecticut property tax records are built on a 70% assessment ratio and an October 1 uniform assessment date. Revaluation is generally required every five years. Use state guidance with assessment statutes and collection statutes to keep context clear.

Connecticut property tax records include real estate values, personal property lines, and motor vehicle tax data. Since October 2024, municipalities follow MSRP-based motor vehicle valuation with depreciation schedules and a statewide capped mill rate for motor vehicles. Many cities use vendor portals for parts of Connecticut property tax records access.

Use municipal assessor directory, municipal tax collector directory, and municipal database references when local pages are hard to locate.

Connecticut Property Tax Records Program Resources

State resources provide baseline context for local records and annual filings. Use homeowner relief program guidance, Department of Revenue Services, and OPM forms and guidance when a request includes exemption or billing policy questions.

For legal references on credits and exemptions, keep Chapter 204a in your notes. The same legal framework supports county and city searches throughout this site.

Note: State agencies publish guidance, but municipal offices remain the source of most Connecticut property tax records.

Connecticut Property Tax Records Images

These state-level images are mapped from the manifest and linked to source pages for Connecticut property tax records research.

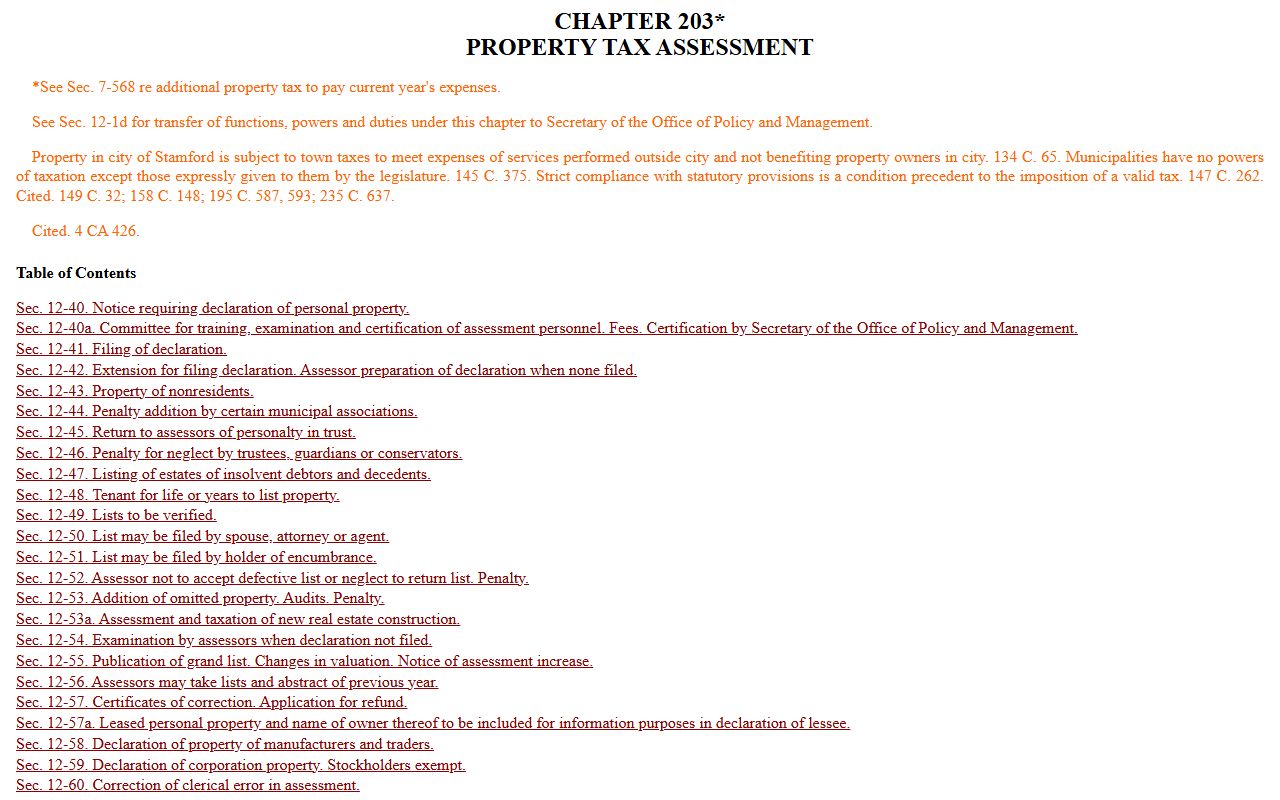

Source view for Connecticut property tax records appears at CT General Statutes Ch. 203 - State.

This screenshot supports the Connecticut property tax records path shown in this section.

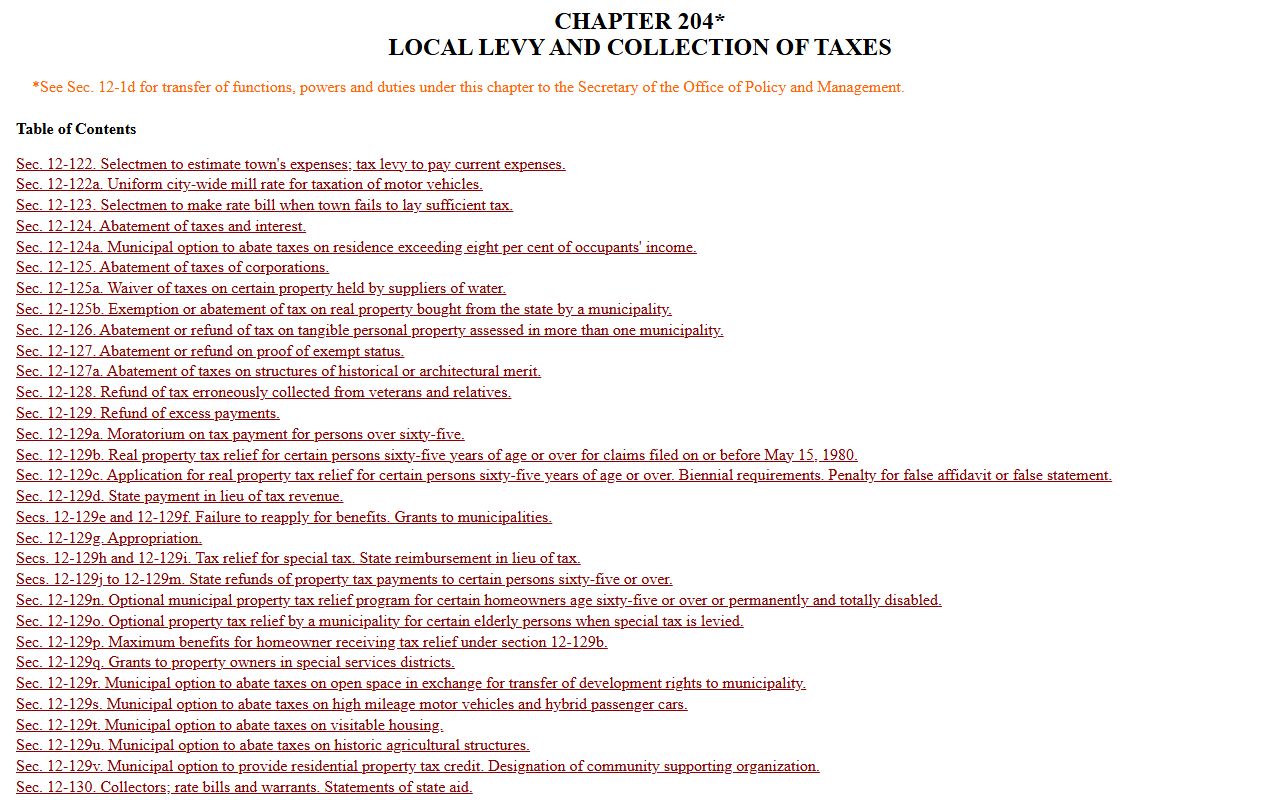

Source view for Connecticut property tax records appears at CT Statutes Ch. 204 - Tax Collection.

This screenshot supports the Connecticut property tax records path shown in this section.

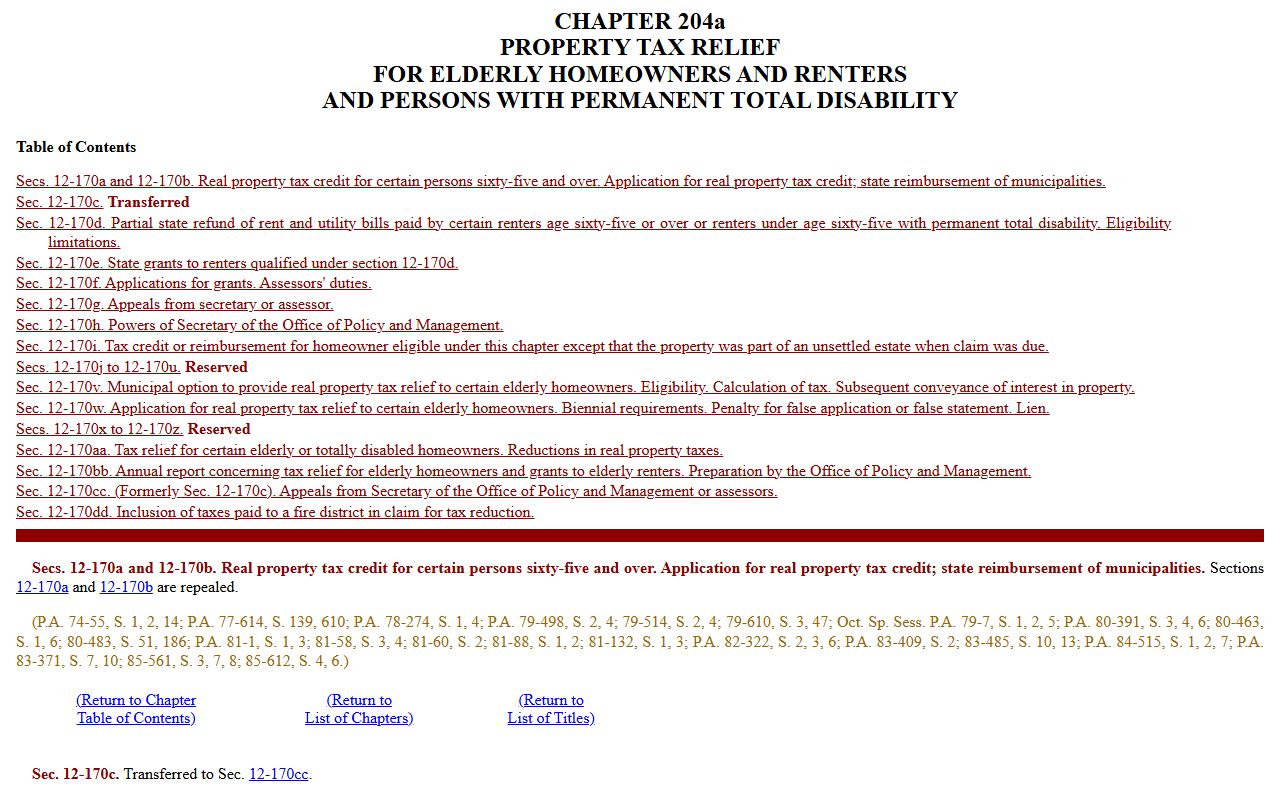

Source view for Connecticut property tax records appears at CT Statutes Ch. 204a - Tax Relief.

This screenshot supports the Connecticut property tax records path shown in this section.

Connecticut Property Tax Records Search Process

Use this process across Connecticut when starting a new property tax records request. It helps keep results accurate across different municipal systems.

- Identify the municipality where the property is located.

- Check the assessor database for parcel and assessment details.

- Review tax collector records for balances and due dates.

- Confirm appeal, exemption, and filing windows.

- Reference statutes when legal context is needed.

This structure works for county pages and city pages in this project and keeps Connecticut property tax records searches aligned with how offices publish data.

Connecticut Property Tax Records Reference Notes

Connecticut property tax records research usually starts with municipal office pages and then moves to statewide legal context. This approach helps when a local site changes because the local office is still the source of record. It also keeps assessment data, billing data, and exemption timelines in one review path.

Connecticut requires consistent treatment of assessment years, tax due dates, and delinquency status. Keep the same terms across each search session so records from separate portals can be compared. This page is structured to support that workflow for Connecticut property tax records.

Browse Connecticut County Pages

Choose a county to view municipal routing links and property tax records guidance.

Connecticut Property Tax Records in Major Cities

Choose a city to open municipal assessor links, collector links, and location-specific record notes.