Hartford County Property Tax Records

Hartford County property tax records in Connecticut are assembled through municipal assessor and tax collector offices, then reflected in local grand list files. Because Connecticut uses municipal administration, Hartford County property tax records are usually found through each city or town office, not a single county assessor. This page organizes Hartford County property tax records search paths, local office links, and state statute references so you can find assessment files, payment records, and related tax documents with fewer delays.

Hartford County Property Tax Records Access

Hartford County covers many municipalities, and each one maintains its own assessment roll, tax billing files, and exemption records. That is why Hartford County property tax records searches often begin with a local assessor page and then move to a tax collector portal. The statewide model is consistent and links office practice to statutory rules for assessment, collection, and tax relief.

Start with https://publicrecords.netronline.com/state/CT/county/hartford for county routing, then use https://www.hartfordct.gov/Government/Departments/Assessor and https://www.westhartfordct.gov/town-departments/assessment as available for local navigation. For statewide support, use https://portal.ct.gov/opm/igpp/resources-and-forms/statutes-governing-property-assessment-and-taxation and https://portal.ct.gov/OPM/IGPP/Directories/Municipal-Assessors. This keeps Hartford County property tax records requests anchored to official sources.

Most municipalities issue bills in July and January. Delinquent balances accrue monthly interest and can affect DMV transactions in some cases. For legal context tied to collection and relief, keep https://portal.ct.gov/OPM/IGPP/Directories/Municipal-Tax-Collectors and https://portal.ct.gov/opm/igpp/grants/tax-relief-grants/homeowners--elderlydisabled-circuit-breaker-tax-relief-program in your notes while checking local data.

Hartford County Property Tax Records Images

Each image below is tied to a researched source and can be used to verify a live entry point for Hartford County property tax records.

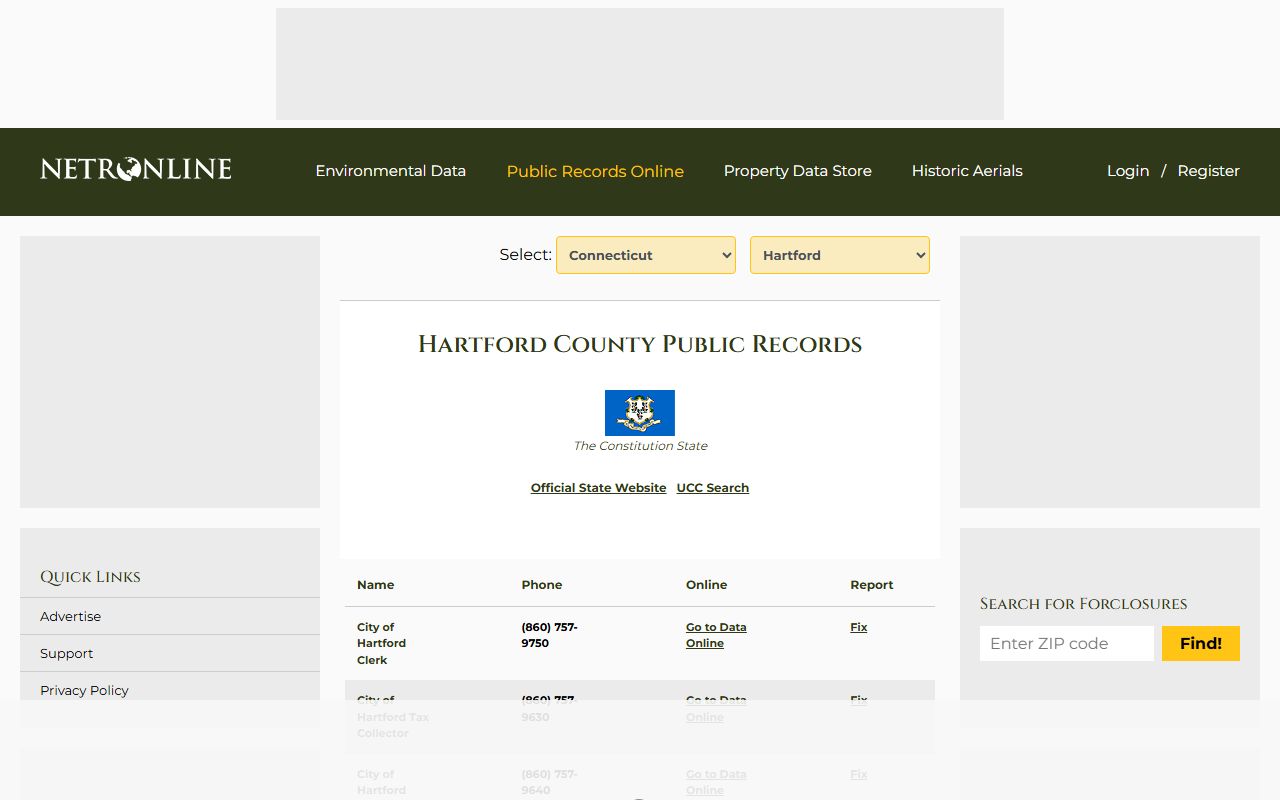

Source view for Hartford County property tax records appears at Hartford County Records - Hartford.

This screenshot supports the Hartford County property tax records path shown in this section.

Hartford County Property Tax Records Steps

Start with the municipality where the property sits. Then confirm assessment entries, billing status, and exemption filing windows. This keeps Hartford County property tax records requests on the right track.

- Find the municipality and open its assessor page.

- Search parcel records using owner name or location.

- Check tax collector billing data for due dates and balances.

- Review appeal windows and exemption deadlines.

- Save links and record identifiers for follow-up requests.

Use this sequence for real estate, motor vehicle, and personal property files. It aligns with how Hartford County property tax records are organized in Connecticut.

Hartford County Property Tax Records Reference Notes

Hartford County property tax records research usually starts with municipal office pages and then moves to statewide legal context. This approach helps when a local site changes because the local office is still the source of record. It also keeps assessment data, billing data, and exemption timelines in one review path.

Connecticut requires consistent treatment of assessment years, tax due dates, and delinquency status. Keep the same terms across each search session so records from separate portals can be compared. This page is structured to support that workflow for Hartford County property tax records.

Cities in Hartford County Property Tax Records

Hartford County property tax records are maintained by these municipalities. Choose a city page for local assessor and collector details.