Find West Hartford Property Tax Records

West Hartford property tax records are handled through municipal offices in West Hartford, with assessor files, grand list entries, tax billing data, and parcel history maintained under Connecticut law. This page gives a practical search path for West Hartford property tax records, including local links, statute references, and image-supported source checks. Use these steps when you need to review ownership records, compare assessments, locate payment status, or prepare appeals and exemption filings tied to West Hartford property tax records.

West Hartford Property Tax Records Office Sources

West Hartford property tax records usually begin with local assessor resources and then move to collector billing pages. The Assessment Office is responsible for discovering, listing, and valuing all real estate, business personal property, and motor vehicles. Real estate and personal property are assessed at 70% of fair market value. As of October 1, 2024, motor vehicle assessments are based on MSRP and depreciation by year and make, in accordance with Conn. Gen. Stat. §12-63(b)(7). Real Estate and Personal Property Mill Rate = 44.78 | Motor Vehicle Mill Rate = 32.46. **Address:** West Hartford Town Hall, 50 South Main Street, Room 142, West Hartford, CT 06107.

**Phone:** 860-561-7414. **Fax:** 860-561-7590. **Email:** WHAssessment@WestHartfordCT.gov. **Hours:** Monday-Friday, 8:30 AM - 4:30 PM. Assessment: https://www.westhartfordct.gov/town-departments/assessment. Contact references for West Hartford include Address: West Hartford Town Hall, 50 South Main Street, Room 142, West Hartford, CT 06107; Phone: 860-561-7414; Fax: 860-561-7590; Email: WHAssessment@WestHartfordCT.gov; Hours: Monday-Friday, 8:30 AM - 4:30 PM

State-level support for office routing is available at municipal assessor directory and municipal tax collector directory. These tools help keep West Hartford property tax records searches stable when local menus change.

West Hartford Property Tax Records Search Links

West Hartford property tax records links should be used in a sequence: assessment data first, tax billing second, then legal references. This keeps record pulls consistent across different systems.

Primary links for West Hartford include https://www.westhartfordct.gov/town-departments/assessment/real-estate and https://portal.ct.gov/opm/igpp/resources-and-forms/statutes-governing-property-assessment-and-taxation. For legal context, keep https://portal.ct.gov/OPM/IGPP/Directories/Municipal-Assessors and https://portal.ct.gov/OPM/IGPP/Directories/Municipal-Tax-Collectors in your file notes.

Records in West Hartford usually include real estate, personal property, and motor vehicle entries. Due dates, grace periods, and delinquency details should be confirmed on local collector pages before final use.

West Hartford Property Tax Records Images

The source-linked images below are mapped from the project manifest for West Hartford property tax records.

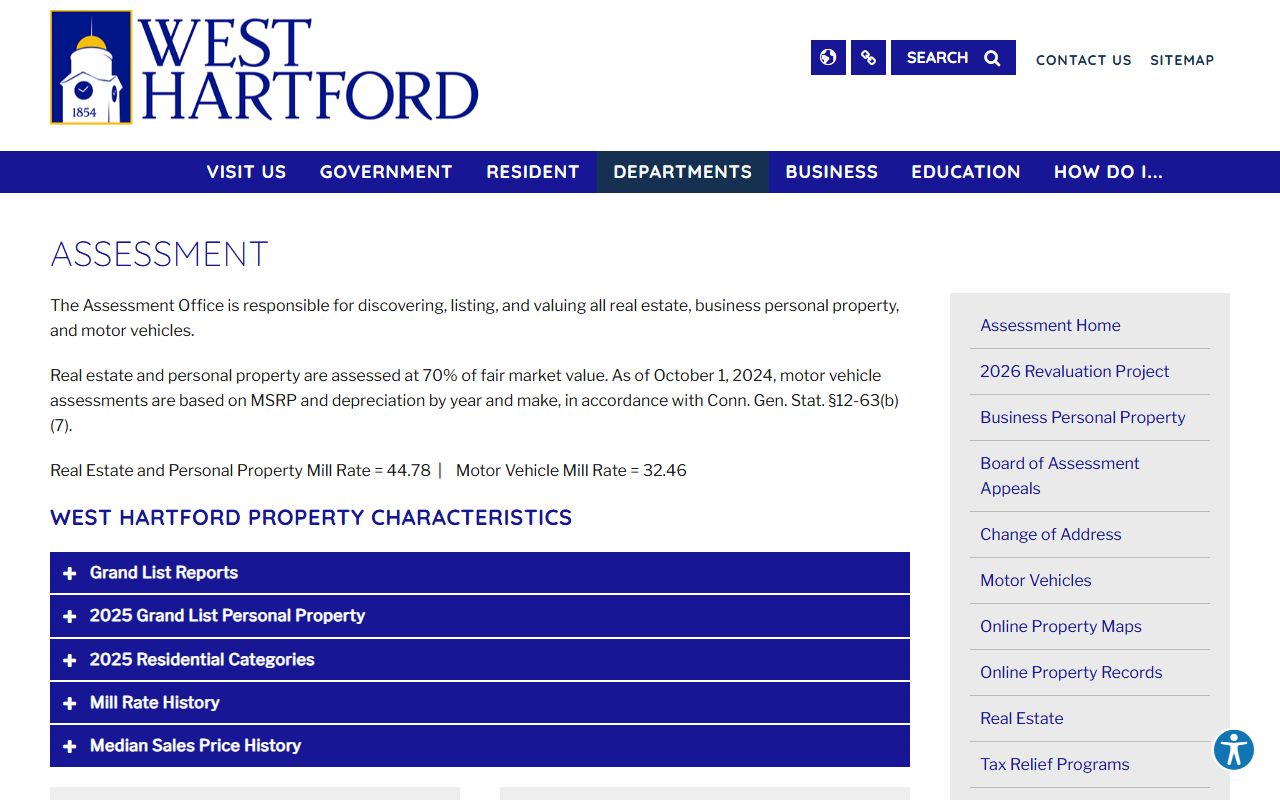

Source view for West Hartford property tax records appears at West Hartford Assessment - West Hartford.

This screenshot supports the West Hartford property tax records path shown in this section.

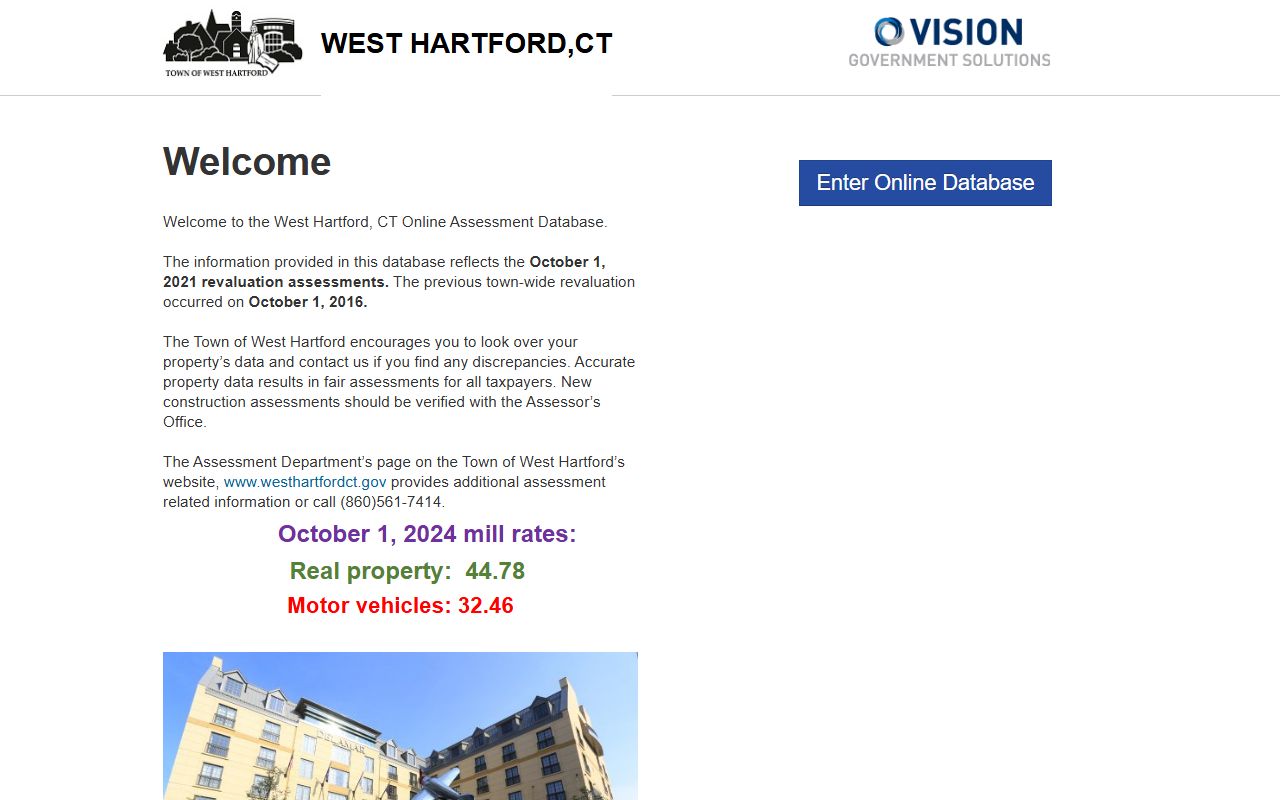

Source view for West Hartford property tax records appears at West Hartford Assessment DB - West Hartford.

This screenshot supports the West Hartford property tax records path shown in this section.

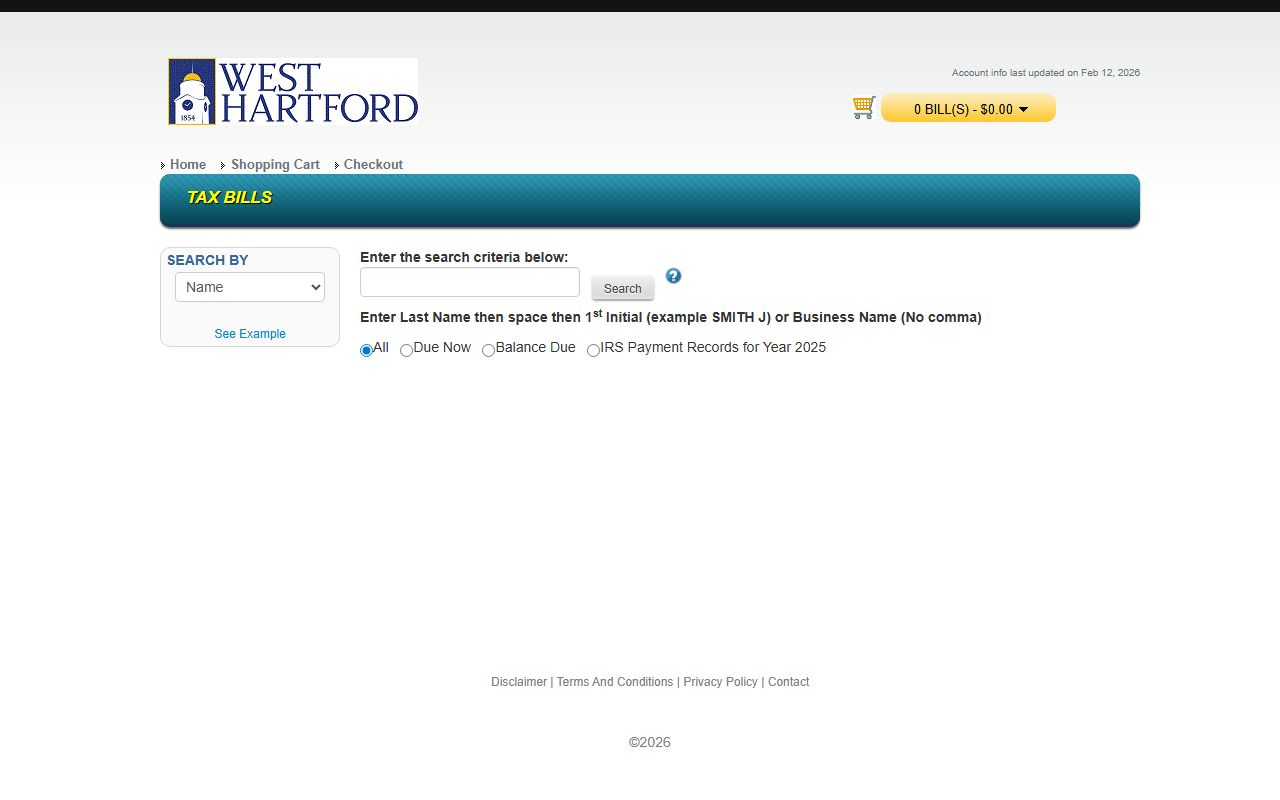

Source view for West Hartford property tax records appears at West Hartford Tax Payment - West Hartford.

This screenshot supports the West Hartford property tax records path shown in this section.

West Hartford Property Tax Records Checklist

Use this checklist when pulling West Hartford property tax records for routine requests and filing support.

- Open the municipal assessor page and confirm parcel details.

- Check grand list year and revaluation notes.

- Review tax collector billing and due date language.

- Check delinquency rules and DMV-related notices.

- Save reference links for follow-up requests.

This workflow matches how West Hartford property tax records are maintained in Connecticut and reduces repeat searches.

West Hartford Property Tax Records Reference Notes

West Hartford property tax records research usually starts with municipal office pages and then moves to statewide legal context. This approach helps when a local site changes because the local office is still the source of record. It also keeps assessment data, billing data, and exemption timelines in one review path.

Connecticut requires consistent treatment of assessment years, tax due dates, and delinquency status. Keep the same terms across each search session so records from separate portals can be compared. This page is structured to support that workflow for West Hartford property tax records.

Hartford County Property Tax Records

West Hartford sits in Hartford County. Use the county page for county-level routing links and additional municipality context.